Run For Your ‘Live’ 🎤🎸

BookMyShow’s newbie live events business is almost back at pre-pandemic levels. Now, it needs to find profits.

Good afternoon!

Welcome to The Impression, your weekly primer on the business of media, entertainment, and content.

If someone shared this newsletter with you or if you’ve found the online version, hit the button below to subscribe now—it’s free! You can unsubscribe anytime.

Smell that? It’s outdoor season. The weather is nice, the holiday season is here, and the family (or loved ones) is visiting. What better way to enjoy the end of the year than with a concert or a nice outdoor festival? (Note: I’m going to politely ignore the rising air pollution 😷)

From now until February, crowds will throng parks, stadiums, theatres, and other venues to attend musical performances, shop and eat, and entertain themselves.

It’s a good time to check in on how the live entertainment business is doing. Big ticket concerts in India were so rare, Michael Jackson’s Mumbai concert in 1996 remains a landmark event for a generation of affluent Indians. When Bryan Adams first performed in 2004 in Delhi, people in the city rushed to the homes of mid-rise buildings nearby to get a glimpse of the performance.

Look at us now. Young ones are complaining about the Lollapalooza 2024 lineup (granted, the acts are tired) and the ones who can afford it already have tickets for Ed Sheeran in Mumbai. The distant memory of grubby concerts and more recently, of strict lockdowns and mask mandates, are all fading away.

So are the good times here for India’s live entertainment hopefuls? Yes but also not yet.

Under the hood: BookMyShow’s Live biz

Concerts or live performances by other international acts are no longer so rare. In the past 7-10 years, companies such as Only Much Louder and BookMyShow have made inroads into the business of concerts, stand-up comedy, musicals, and other live performances.

It makes sense to branch out from plain old ticketing to producing events of your own. Not least because in the cinema business, dominant player PVR is actively pushing its own ticketing app and subscription plans such as PVR Passport to directly woo customers.

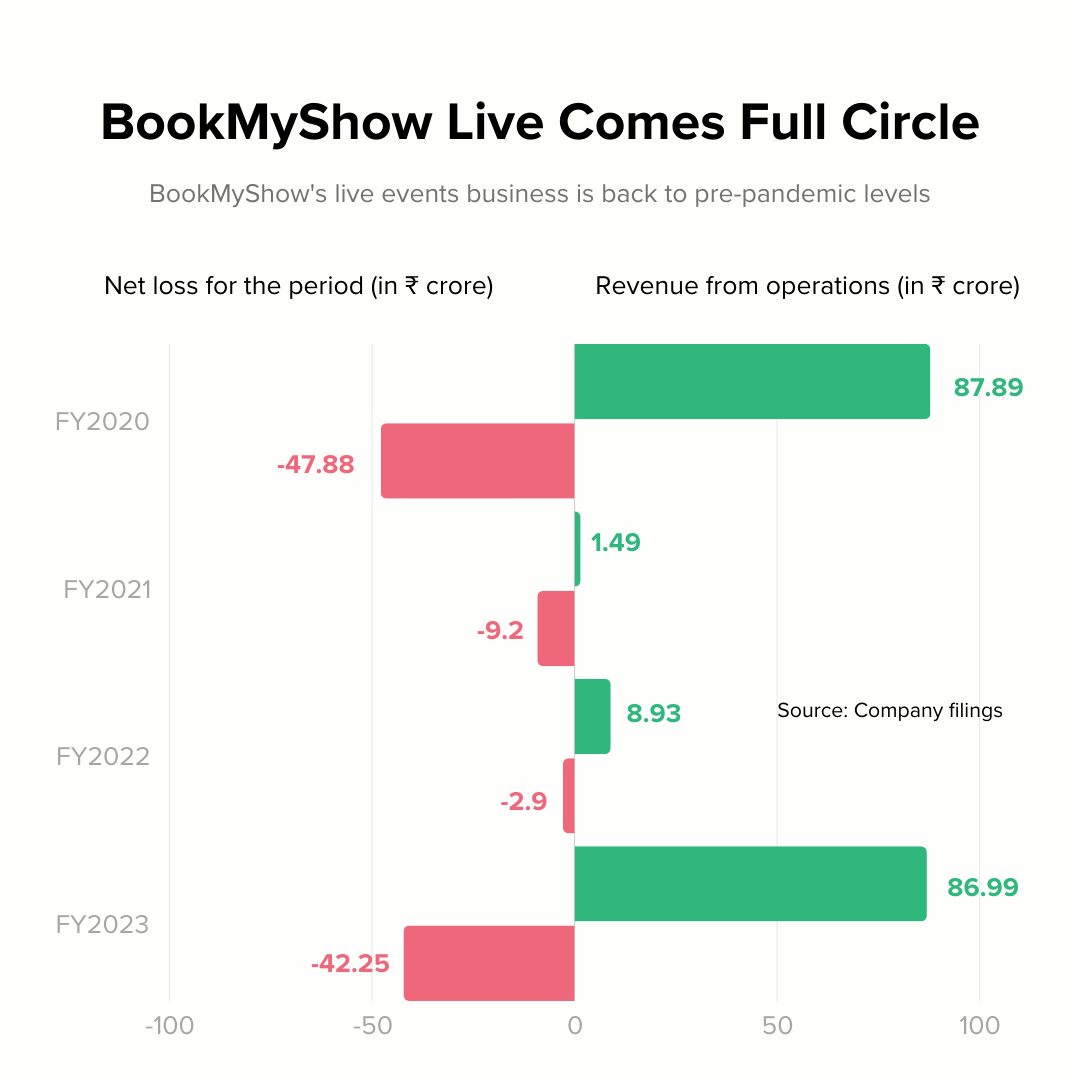

BookMyShow’s live business shrank to a fraction of its size during the pandemic years. Now, in its first full year after Covid-19, the company has bounced back to nearly the same size it was in FY20, just before the lockdown began in India.

Parent firm Big Tree Entertainment reported ₹237.48 crore (~$28.5 million) in revenue from the live events business for FY23.

The recovery validates what consulting firm EY already estimated in its media & entertainment report for the year (pdf). The pandemic decimated India’s live events business, which fell to a third of 2019 levels. It recovered to about 88% by 2022. EY expects live events to outgrow pre-pandemic levels this calendar year.

BookMyShow did not respond to requests for a comment.

Pre- and post-pandemic, BookMyShow has also made some fundamental shifts in the way it runs the live business. Early in its foray, it was licensing Disney originals such as Aladdin and Beauty and the Beast to produce local Broadway-style musical live shows. This year, it hosted a range of concerts including Bandland and the inaugural Indian edition of Lollapalooza, along with a tour of comedian Trevor Noah, two ‘90s boy bands (Backstreet Boys and Westlife), and e-commerce platform Nykaa’s first ever shopping and beauty festival Nykaaland.

The shift is simple: invest more in high-profile and original IP. BookMyShow has also roped in new talent to aggressively grow the business. In 2022, long-time events and marketing executive Owen Roncon became the company’s chief business officer for live entertainment.

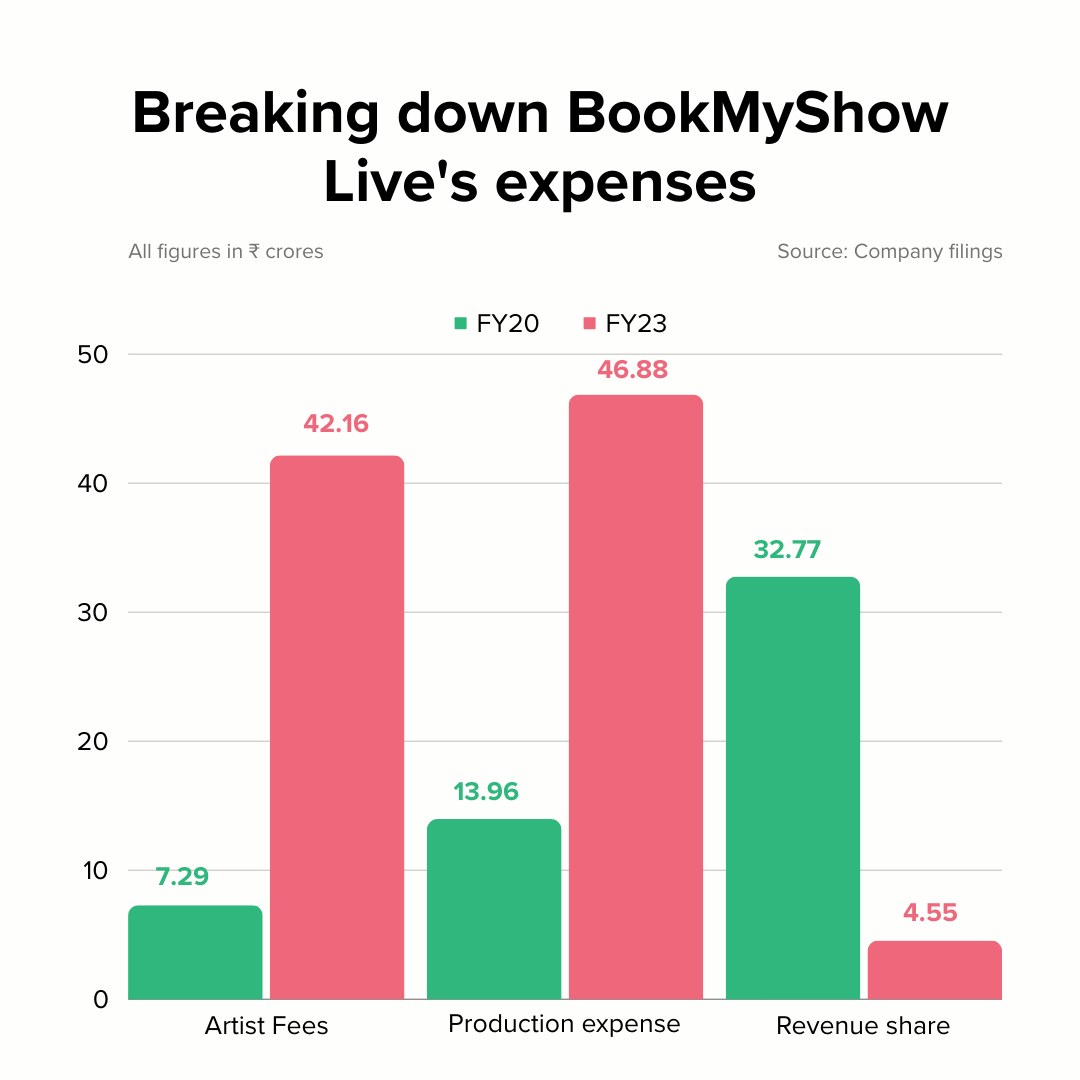

Already, the shift in priorities is evident in the company’s financials. BookMyShow Live’s biggest expenses were under the ‘miscellaneous head’; these are largely costs associated with licensing IP and producing live shows.

In FY19, the biggest chunk of these expenses went in ‘revenue share’, followed by production expenses and stage fees, while artist fees remained lower.

Skip to today, the company is now spending far more on artist fees and production expenses, with a mere 4% of total expenses in FY23 going in revenue share. That ties in well with the kind of shows BookMyShow is putting up now: foreign talent, bigger venues, and more ambitious productions translate to higher costs. The payoff though, is that BookMyShow gets a neat little portfolio of high value IP.

Risks to growth

Live events are a cash guzzler and building your own IP is not without risks. Just as in FY20, BookMyShow Live made significant losses in FY23.

Compare this with Insider.in, the ticketing platform built by events firm Only Much Louder and now owned by payments company Paytm. The company avoided investing in producing shows and chose to focus exclusively on selling tickets to live (and online) events. Compared to BookMyShow Live’s, Paytm Insider’s losses are slim, at about ₹19.22 crore (~$2.3 million) in net loss on revenue from operations worth ₹191.22 crore (~$22.9 million).

But Insider’s operations pale in comparison to BookMyShow’s main ticketing business. As of FY23, BookMyShow’s standalone revenue from operations (read: ticketing) were nearly 4x those of Paytm Insider. Besides, it made a healthy 23% net profit margin compared to Insider’s losses. However, Insider sustained operations much better during the pandemic; it’s revenues from operations for FY23 are nearly 5x of pre-pandemic levels. But this divergence in FY23 performance could also be because the cinemas business picked up dramatically earlier this year, boosting BookMyShow’s ticketing business.

BookMyShow has enough cushioning to fall back on as it allocates cash to its live events business (along with an online streaming service on the BookMyShow app). But it still has to contend with growing India’s live events market and combating a slowdown in both consumer discretionary spending and advertising spends. As per the EY media & entertainment report cited above, growth in live events will largely come from ‘managed events’. These are restricted live events run by government bodies, private companies, and individuals.

That’s at odds with BookMyShow’s strategy of focusing on high octane, big budget events featuring top domestic and international talent. If it can find a way to keep all that coming and do it profitably, India will have a live events major of its own.

Last Scroll Down📲

Scan the big media headlines from the week gone by

No more 💰: Looks like only politicians can help advertising. Despite the rise in election spending in the US, growth in global ad spends will slow down to 5.3%, media investment group GroupM said. 2024 is a major election year for India too; since October this year, top ad agencies have been pitching to national parties including the BJP, the Congress, and the Aam Aadmi Party.

Enemy at the gates: Streaming platforms are finally going head-to-head with the Indian government. Netflix, Reliance’s Viacom18, and other platforms will lobby to change or at least delay a proposed law that requires platforms to have content evaluation committees to review everything they release online. India has been pushing for ‘self-regulation’ in online content, but proposing laws that effectively kill digital news, entertainment, and communications businesses.

Musical chairs: India’s music industry crossed ₹12,000 crore (~$1.44 billion) in revenue, nearly half of which came from online music streaming, per estimates from consulting firm EY (pdf). In fact, almost all of India’s music recording revenue comes from streaming platforms, EY found. Yet, these platforms are struggling globally. This week, Spotify cut 17% of its workforce despite better-than-expected results as it struggles to scale up and sustain margins. This is their third round of layoffs this year.

Spotify is also sprucing up its podcasting division. It cancelled two critically acclaimed shows made by Gimlet, the studio it acquired in 2019. It also rolled out Spotify Audience Network in India, allowing advertisers to place ads in podcasts for both free and paying users.

Need for tweaks: Looks like the World Cup heartbreak is turning cricket fans away from India’s ongoing T20 series with Australia. So much so that JioCinema, which has the streaming rights to the tournament, has changed how it shows views on its platform. Instead of concurrent views on its counter, JioCinema will now show cumulative views that a piece of content has had at any given point of time.

Not playing games: And not streaming them, either. Amazon’s esports streaming service Twitch is shutting operations in South Korea. It blamed high network fees, paid by platforms to telecom companies to use their network. India is considering a similar setup.

Trumpet 🎺

Dissecting this week’s viral ‘thing’

There is so much ‘content’ to see, we’re drowning in it. It has probably never been harder to grab the audience’s attention and coax people to watch your film, series, or online video. Big budget films are spending the equivalent of a small budget film to market themselves and ensure the audience fills seats. So, it’s hard not to appreciate what T-Series and director Sandeep Reddy Vanga have achieved with the Ranbir Kapoor-starrer Animal, which released last week.

Now, I must confess I haven’t seen the film yet, but I think I (and many others) may have absorbed a good 40% of its runtime via the endless acerbic reviews, memes, angry/admiring tweets, and shitposts the film has inspired. That’s an achievement in itself: very few movies manage to get such a chokehold on the popular imagination. Producer T-Series Films says Animal has grossed nearly ₹500 crore (~$60 million) worldwide.

Take a look at the comments on this T-Series post: the film has divided viewers into two angry groups. One alleges the film is a violent glorification of a misogynist, something Vanga was accused of with his previous blockbuster about a troubled lover, Kabir Singh. Another group is loving what it believes to be a no-holds barred depiction of ‘alpha’ men and their rightful desires. There’s no better way to make sure all eyes are on you and your film than to whip up anger amongst your intended audience. Vanga seems to understand this well.

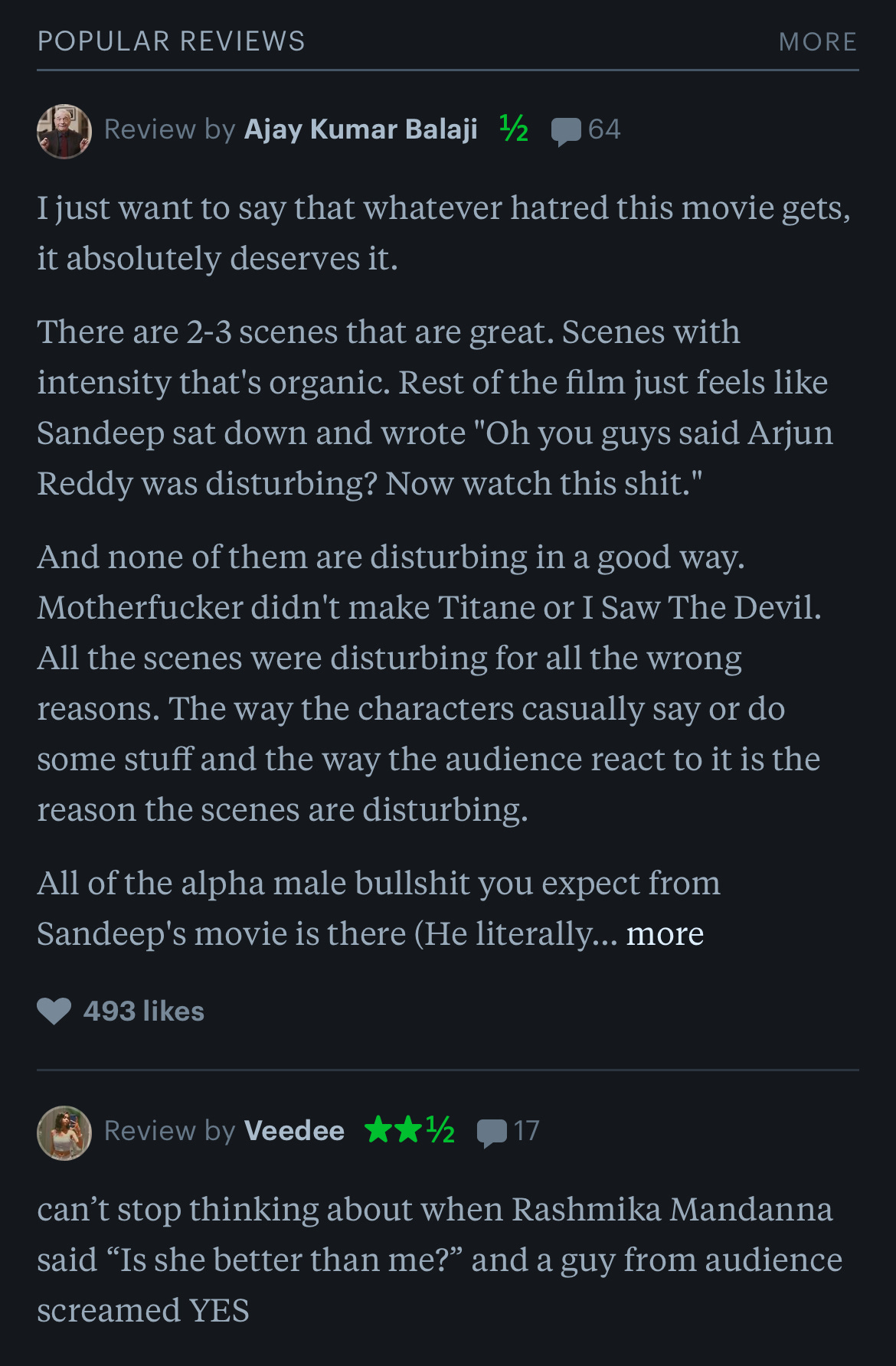

For those of you who are yet to see Animal, I recommend grabbing some popcorn and going through the viral hilarious reviews of the film on Letterboxd instead; they might be more entertaining than the film itself.

That’s all this week. If you enjoyed reading The Impression, please share it with your friends, family, and colleagues. And please write to me anytime at soumya@thesignal.co with thoughts, feedback, criticism or anything you’d like to see discussed in this space. I'd love to hear from you.

Thanks for reading, and see you again next Wednesday!