Pocket Change

It’s been 10 years since Pocket Aces rose to popularity, then morphed from a YouTube multi-channel network to an independent streaming content studio. Now, it’s been acquired for a modest sum. What does the deal tell us about the YouTube-to-OTT pipeli

Good afternoon!

Welcome to The Impression, your weekly primer on the business of media, entertainment, and content.

If someone shared this newsletter with you or if you’ve found the online version, hit the button below to subscribe now—it’s free! You can unsubscribe anytime.

The 2010s were a good time to do sketch comedy on YouTube. A number of channels dedicated to jokes and skits about the vagaries of life soon morphed into multi-channel networks (MCNs) and, eventually, full-fledged production studios, thanks to streaming. Once Netflix opened shop in India in 2016 and more platforms followed suit, there was a tsunami of original films and shows online. That demand fuelled the rise of companies like Pocket Aces, which ran popular YouTube channels like FilterCopy and later produced the hit show Little Things.

This party is now ending. Last week, the music label Saregama India announced (pdf) it was acquiring a majority stake in Pocket Aces for ₹174 crore (~$20.9 million) and will buy another 41% in the next 15 months. This deal values Pocket Aces at roughly ₹335 crore (~$40 million), lower than the $53 million valuation it raised at in 2019.

An exit is still good news for Pocket Aces’ investors, including Peak XV Partners (formerly Sequoia India) and 3One4 Capital. But Pocket Aces’ story shows us two things: one, that the YouTube MCN model has only so much value and two, not every YouTube channel can morph into a successful production studio.

Pocket Aces’ Pocketful of Dreams

Photo by Joshua Rawson-Harris on Unsplash

When Netflix and Amazon Prime Video first began commissioning original content in India, they went to established film studios in Mumbai, such as Farhan Akhtar’s Excel Entertainment (Mirzapur) and the indie-film powerhouse Phantom (Sacred Games). Soon enough, platforms figured out that they need more than just slow, dark, gritty shows to pull older viewers from TV and younger ones from YouTube.

Pocket Aces grabbed the opportunity with both hands. While these ‘prestige’ streaming shows were getting made, Pocket Aces was growing into a successful multi-channel network (MCN), building a massive audience on YouTube with relatable sketches, especially about young love (such as the pangs of school romance or the pain of being single). FilterCopy’s hold over young, affluent, urban Indians culminated in the hit show Little Things, which is about a live-in couple. Netflix India acquired the show later. Since then, Pocket Aces and its sub-brands have made light, fun, family-appropriate shows that were tailor-made for its young target audience. These included Crushed (2022) and Adulting (2018), both streaming on Amazon miniTV, and Ghar Waapsi (2022) on Disney+Hotstar.

However, YouTube remained central to Pocket Aces’ success, even after producing successful streaming originals. In 2020, the company said it crossed over a billion views a month for all its shows, mostly from the millions of followers on its YouTube channels. On the back of these views, it began making content for advertising clients such as PepsiCo and Hyundai. At the time, half of Pocket Aces’ revenues came from these advertising deals.

But this success never showed in the company’s financials. Pocket Aces’ revenue has been growing steadily. It closed FY22 with over ₹97 crore (~$11.65 million) in revenue from operations, and Saregama said this number stood at ₹104 crore (~$12.5 million) in FY23. However, filings show the company hasn’t made profits since at least 2015. Starting with a modest ₹19 lakh in FY15, Pocket Aces’ losses rose to just under ₹8 crore in FY18, then more than doubled to over ₹18 crore in FY19. It made losses worth ₹51 crore in FY21. Then, they fell sharply to ₹5.9 crore in FY22. As late as February this year, the company was cutting losses and laying off people while looking for someone to acquire the company.

Pocket Aces’ co-founder and CEO Aditi Shrivastava did not respond to a request for comment.

What wasn’t working for Pocket Aces? While it caught the OTT wave just in time, the studio could not evolve to become like bigger rivals such as the Birla group’s Applause Entertainment (Scam 1992, Criminal Justice). It kept making relatable, light-hearted entertainment with fresh faces but not large-scale, big-budget ‘prestige’ shows that a streaming platform could market as its flagship hit. Besides, several of its recent hit shows were on the ad-supported, mass-entertainment platform Amazon miniTV (now merging with Prime Video).

“When you start making more and more shows in a very short timeline and tight budget, it is very difficult to make good margins,” a senior writer in the streaming industry told The Impression, requesting anonymity. “Platforms like Amazon miniTV have very tight budgets, make shorter-episode shows, and prioritise quantity over quality because they are making money from ads. So, a five-episode series that could take a year or more to make will get written, shot, edited, and released in just a few months. Ultimately, you are on a treadmill. To make money as a production house, you will have to keep churning out shows like these at an unsustainable pace. Is there even demand for that many shows which may not have a clear USP or novelty factor?”

Evolve or Perish

Compare this with rival TVF. It, too, started with sketch comedy on YouTube, appealing to teens and young adults in urban India. And it also raised its last major round of funding in 2019. However, TVF translated its comedy to cult classic shows starting way back in 2015 with TVF Pitchers, often compared to HBO’s Silicon Valley. Since then, it has made hit shows like Panchayat (Amazon Prime Video), Aspirants and Gullak (SonyLIV), Kota Factory (Netflix), and Hostel Daze (Amazon Prime Video). From its urban comedy about family, friends, and love, TVF expanded to a bigger budget studio with shows across the social milieu, tapping into nostalgia of the 1990s’ golden age of television while picking themes that resonate with chronically online students and young adults. TVF also doesn’t sell its shows; it licences the IP to bidding platforms and usually does so only after releasing the first season of its show on YouTube for free. Besides, it has now launched a feature films division.

But even after getting acquired, Pocket Aces is not likely to pivot to this sort of content.

In the stock exchange filing announcing the deal, Saregama said it will use Pocket Aces’ 95 million collective YouTube followers to “further popularise its music library among the 18-35 audience segment” (pdf). There is a passing mention of creating “synergies'' between the two companies in managing influencers and creating longform video content. Remember, Saregama has its own movie division named Yoodlee Films, but the company has been going slow on it. In May, managing director Vikram Mehra told investors (pdf) that he won’t put in more than 18% of the company’s total capital in films.

Amassing a massive YouTube audience is a good starting point for an aspiring production house, but it is no longer enough. Many more independent studios and individual producers are competing to make content for streaming today. Meanwhile, platforms are tightening budgets and acquiring cheaper content for ad-funded subscription tiers.

All this is leading to a content glut, and it is harder for the multi-channel networks of the 2010s to make money from this business. Others from that time have also slowly faded away. For instance, Rainshine Entertainment acquired Culture Machine, backed by Tiger Global and Times Internet, in 2019. Creator Tanmay Bhat has a multi-channel network of its own, but he is also making money creating professional ads for clients like CRED, Lenskart, and Shark Tank India. Even globally, the MCN business model has had limited success.

So, what can a 2010s YouTuber do? There are two options. Evolve and become a full-fledged production studio that can compete with legacy rivals. Or find a bigger one who can acquire you for the only real asset you have – a YouTube audience.

Last Scroll Down📲

Tenor

X vs X: You can’t make this up. A Florida-based marketing agency called X Social Media is suing Elon Musk’s social media company X Corp, formerly Twitter, for trademark violation. X Social Media claims it owns the brand name ‘X’ since 2016 and that Musk’s Twitter rebranding has confused its potential clients and caused a loss of potential revenue. Musk bought back the domain name X.com from PayPal in 2017 – it is now the new address for Twitter.

Gagged: The Delhi Police has arrested Prabir Purkayastha, founder of the news portal NewsClick, under the non-bailable Unlawful Activities (Prevention) Act (UAPA). NewsClick allegedly took funding from people associated with the Chinese government. The police also raided the homes of several journalists and contributors who worked for the company and confiscated their electronic devices. The New York Times had first reported that NewsClick may be linked to Neville Roy Singham, an American businessman accused of fuelling Chinese government propaganda. Meanwhile, in the US, a police chief was suspended for raiding a local Kansas newspaper.

No free scrolls: Social media companies want need you to start paying up. X (formerly Twitter) has signed a deal with celebrity heiress Paris Hilton to create live shopping videos for the platform. Meta is planning to offer Facebook and Instagram free of ads in the EU for $14/month. Meanwhile, TikTok is testing an ad-free subscription tier that may cost $4.99 a month.

Boxed and bagged: Letterboxd, the film reviews website that shot to fame during the pandemic with candid reviews from movie and TV stars, has been acquired for over $50 million. The company also owns a film magazine and a podcast, and competes with IMDb, which Amazon acquired in 1998 for an undisclosed amount. It now forms the backbone of Amazon Prime Video.

Trumpet 🎺

| |||

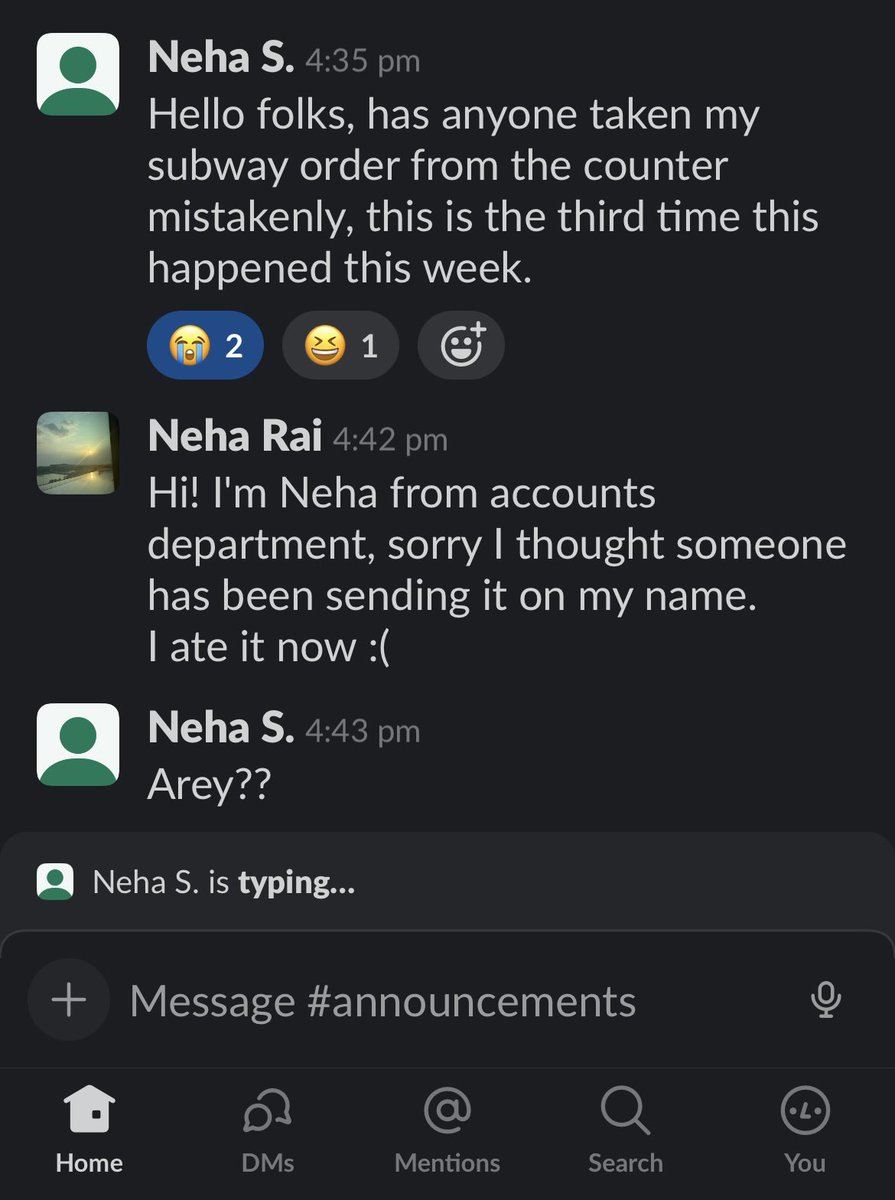

aaj office mein kalesh hua hai 😭🤌 | |||

| |||

Sep 29, 2023 | |||

| |||

9.71K Likes 628 Retweets 422 Replies |

Would you still laugh at a meme if you knew it was also an ad?

Like this one floating about on X for a few days now. Although Subway India has not officially confirmed it, this office chat screenshot with the (slightly unnecessary) reference to Subway is probably an ad for the fast food chain.

This isn’t the first such instance of ‘stealth ads’ found on X. Just last week, fintech firm CRED began trending when meme pages shared videos of strange cars leaving the company’s Bengaluru office. Turns out the entire exercise was an ad for their newly launched service, CRED Garage. And last year, this tweet featuring a girl sobbing about a breakup went viral, but it was merely a promo for a sale on the fashion e-commerce site Myntra.

Brands targeting urban, affluent, younger consumers are getting a little carried away in making their pre-buzz marketing or meme marketing campaigns as ‘organic’ as possible. Memes are a great way to get on top of an audience’s mind, given that attention and engagement drops on posts that are clearly marked as ads. Is it okay then to create original content instead, share it with meme pages and creators, and flood a platform with no disclaimers whatsoever?

For one, India’s Advertising Standards Council of India will object to this tactic. More than two years ago, the industry body asked all social media influencers to publicly disclose any promotional content and label it prominently using hashtags such as ‘paid partnership’. Clearly, no one is paying attention to the rules.

Even if brands are able to escape ASCI’s watch, there are plenty of savvy online users who recognise such ‘stealth ads’ and call them out. One new way people are doing this in Hindi is writing “aaj admin paneer khayega” (today, the admin will have paneer), or simply “paneer post” in the comments under an obvious ‘stealth ad’. The paneer reference is a Hindi-heartland joke about getting paid well enough to afford paneer for a day. It’s a gentle but effective reminder to influencers that their audience knows when they’re trying to sneak in paid promotions in their feeds.

There’s no point to a ‘stealth ad’ if your audience can easily recognise it, is there? One could argue that doesn’t matter. As long the meme is good enough (or weird enough) to go viral, the stealth ad has done its job. The haters can grumble, but everybody – the brand, the influencer, and the agencies involved – gets to have paneer for the day.

That’s all this week. If you enjoyed reading The Impression, please share it with your friends, family, and colleagues. And please write to me anytime at soumya@thesignal.co with thoughts, feedback, criticism or anything you’d like to see discussed in this space. I'd love to hear from you.

Thanks for reading, and see you again next Wednesday!