Old Tech, New Bottle

For years, Snap Inc. has lagged its Big Tech peers in India’s digital ads industry. Now, it’s hoping to woo local brands with a relatively old-school pitch: AR.

Good afternoon!

Welcome to The Impression, your weekly primer on the business of media, entertainment, and content.

If someone shared this newsletter with you or if you’ve found the online version, hit the button below to subscribe now—it’s free! You can unsubscribe anytime.

A quick note: we’re taking next Tuesday (November 14) off for Diwali, so there won’t be an edition of The Impression next week. I’ll be back on November 22.

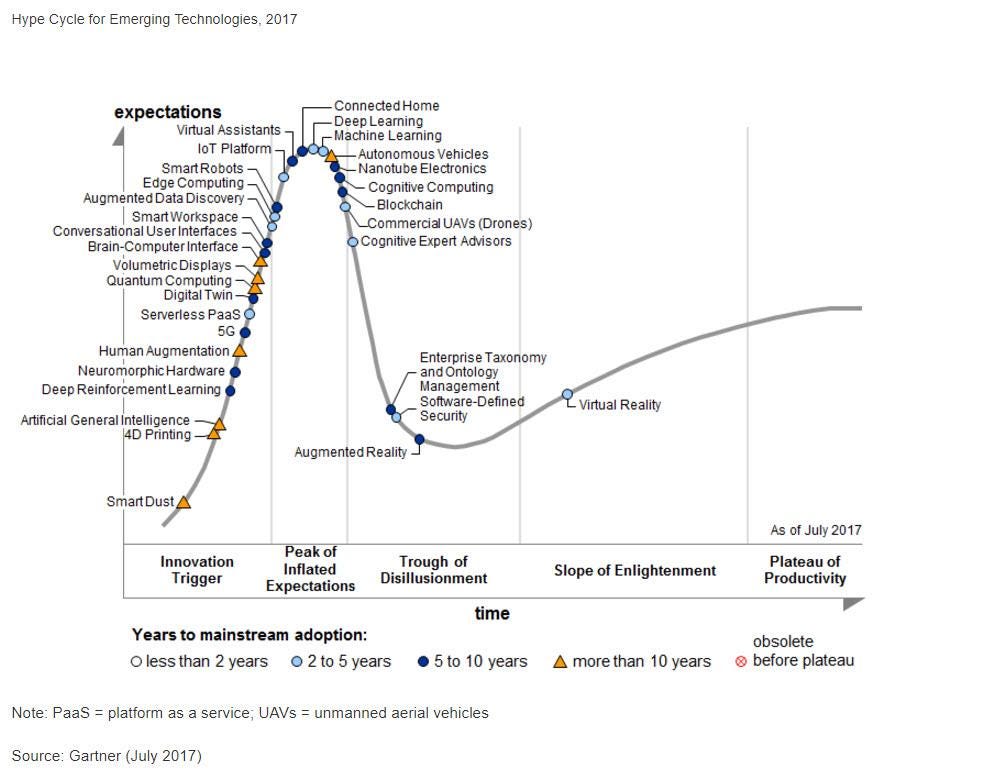

Back in 2017, Snapchat’s parent firm Snap Inc. listed on the New York Stock Exchange in the midst of a tech IPO frenzy. That year, technology consulting firm Gartner’s Hype Cycle report placed Augmented Reality or AR near the bottom of the “trough of disillusionment”. Hype Cycle is an annual report that identifies emerging technologies and ranks them based on their maturity, commercial viability, and the hype surrounding them. The “trough of disillusionment” is where Gartner says a technology drops off to after its hype is all maxed out but its commercial applications haven’t become commonplace yet.

In Hype Cycle 2010, AR was the ‘hot’ thing, sitting on the “peak of inflated expectations”. Twelve years later, AR didn’t even figure in Hype Cycle 2022. Today, tech conversations all echo the same thing: AI, AI, AI.

So why is Snap Inc.’s top brass flying to India to pitch a future built on AR?

Can Snap sell India on AR advertising?

At Snap’s first-ever AR Day for India this week, co-founder and CEO Evan Spiegel had a surprise cameo to a massive round of applause. He showed up for a fireside chat with Ajit Mohan, the company’s Asia-Pacific head.

Spiegel’s appearance was brief, but he made sure to emphasise just how crucial AR is to the future of creativity, and the important role India will play in shaping it.

“What is so exciting about India is just how many young people there are,” Spiegel said. “There’s a huge number of young people creating…and I think augmented reality is going to be a key part of that. So, getting people on augmented reality experiences to express themselves or helping brands get more distribution or just building things for fun, I think there is an enormous amount of opportunity with the 200-million-plus folks who are on Snapchat in India and growing.”

Spiegel’s remarks come only a few months after he announced Snapchat’s monthly active user base in India had doubled from 100 million in October 2022. Snap’s India unit made a modest profit in FY22 (latest available financials) even though the parent firm posted losses in the quarter ended September 2023 (pdf).

I’d written in this edition of The Impression that with a significant user base in the bag, Snap needs to a) build a more robust network of creators and b) grow its ad offerings from basic performance advertising to more innovative (and more lucrative) brand marketing inventory.

Getting Indian advertisers excited about AR Lens Ads may be a way to do that. But Snap has a couple of hurdles to cross.

What’s so special about AR?

Snap’s AR ads include brand-sponsored Lenses or filters that the people on the app can use when creating photos or videos. Some Indian brands have already used these filters, including Flipkart earlier this year. The e-commerce giant let users turn into ‘FlipGirl’ and play a shopping game on the Snapchat app.

There are other applications too: retail brands can let customers use their custom filters to try out a lipstick, a shoe, a pair of glasses, or even a dress. These branded filters were on demo at the AR Day event in Mumbai.

AR ads like these may not necessarily lead to conversions like a ‘click to buy’ performance ad does, but they do allow brands to get on top of their target customer’s minds. Besides, these AR applications are hardly new; for years, Nykaa has had an AR filter that lets customers try on a lipstick shade virtually. Lenskart has had a similar try-out feature for its frames since at least 2016.

There are many more new, innovative digital ad formats to choose from today. E-commerce ads, including sponsored product listings, banners, and livestreams are gaining traction among Indian consumer-facing brands. So much so that Amazon is slowly eating into Meta-Google’s digital advertising duopoly; and rivals, including Flipkart, Myntra, Zomato, and Nykaa, are scaling up their ads businesses.

Then, there is video, including vertical video apps (primarily Instagram Reels) and now, increasingly, audio-format ads on both music (such as Spotify) and non-music (such as Pocket FM) platforms.

Augmented Reality ads don’t figure high on Indian marketers’ priorities just yet (marketers in mature markets aren’t so keen either). In a survey for their annual media & entertainment report (pdf), EY-FICCI found only half of the chief information officers of M&E companies were keen on using AR (or VR) to make ‘immersive’ ads. Indian consumers aren’t so exposed to the tech either: the report estimates only about 10-15 million Indian households will interact with AR or VR by 2025 and that the current user base is “sparse”.

Snap is aware of these challenges. In his presentation, company executive Ty Ahmad-Taylor had a slide titled “Brands need convincing”. He acknowledged that marketers still wanted proof that AR could be a good way to connect with customers. But he argued, citing data from a survey Snap conducted, that customers are more than willing to use AR when picking out something to buy. However, this survey was conducted in largely European and North American markets.

Besides branded filters, Snap used the presentation to pitch AR experiences it could make for brands. Resh Sidhu, Snap’s global director of the Arcadia Creative Studio, presented a couple of such AR use cases, including an interactive Coke vending machine and a partnership with events firm Live Nation to offer AR features to music festival attendees.

What Snap’s executives didn’t mention in their presentations is that in September this year, the company closed a division called AR Enterprise Solutions that worked on some of these projects. According to Bloomberg, Snap made the decision just months after launching the division because it needed too much upfront investment, and generative AI had eviscerated the competitive advantage Snap’s AR services for brands had.

Where’s the content?

Getting advertisers excited about AR is one half of the problem. The other half: getting Snapchat users to browse content. Snapchat’s original value proposition was to be a messaging platform that allows privacy with disappearing photos and videos. Its users are known most for maintaining ‘streaks’ or a chain of unbroken messages.

A lot has changed since those early days of the app; Snapchat now has stories and Spotlight, an endless feed of public short videos just like TikTok, Instagram Reels, and YouTube Shorts. For now, Snap Spotlight hasn’t cultivated well-known creators the way Instagram Reels has done (and YouTube Shorts is now doing). Besides, Snap’s challenge is getting people to stop just sending private messages and actually engage with Snapchat Spotlight.

“...when it comes to content penetration, that's really going to be driven by emerging countries where…our growth is earlier in its cycle,” Spiegel told investors in an earnings call late last month. “And so, folks are just ramping up with our communications products and have yet to really transition to the content-focused products.” Snap is hoping that it can redirect new Indian users, who aren’t familiar with Snapchat’s original value proposition, to see it as a video-sharing app rather than just an app to message one another.

It is possible to monetise messaging. WhatsApp has been so successful at it that Meta’s founder-CEO Mark Zuckerberg highlighted it in an earnings call last month (pdf). “Business messaging also continues to grow across our services and I believe [it] will be the next major pillar of our business,” he said. “Every week now, more than 60% of people on WhatsApp in India message a business app account. Revenue from Click-to-Message ads in India has doubled year-over-year.” Meta’s India unit recorded 18% growth in ad revenue for FY23.

That’s not Snap’s strategy, though. From its AR Day presentation, it’s clear the company doesn’t have a new pitch for its AR LensAds and services tailor-made for India. Perhaps it believes that Indian advertisers won’t be as pessimistic about the potential of AR as their counterparts in North America and Europe are.

Meanwhile, Snap is investing in a network of local creators who develop Snap Lenses. In August this year, the company launched a Lens Creator Rewards programme, paying Snap creators whose Lenses go viral in select markets, including India. Of those awarded so far, half are Indian creators, Snap’s director of product Jeremy Voss said at the APAC AR Day presentation. Some of these creators were guests at the event.

But the bottomline is AR is a hard sell both in India and abroad. When considering expensive options for ‘experiential’ marketing, brands are spoilt for choice. Big ones are simply hosting plain vanilla in-person events (see this edition of The Impression about ‘Nykaaland’) or conducting experiments with AI and the metaverse to grab attention. To get its India strategy right, Snap may need new filters for itself.

Last Scroll Down📲

Scan the big media headlines from the week gone by

Look what you made me do: Only Taylor Swift and her fans could make this happen. Swift’s re-recorded version of her 2014 album 1989 has already surpassed sales of the original, just a few days after its release. The singer-songwriter has been re-recording her first six albums after investment firm Shamrock Holdings acquired the rights to them from music manager Scooter Braun in 2020 (this Bloomberg story has more details on how she did it). It’s been a cruel good summer for Swift all-round. Her Eras Tour has been a runaway success, so much so that it’s become difficult to estimate just how much she has earned from it.

Look-see: Investigative reporting collective OCCRP says their Indian reporter Anand Mangnale was targeted by government-backed hackers who tried to plant sophisticated spyware on his iPhone. The OCCRP recently published a report alleging the Adani Group was manipulating group company stocks. Meanwhile, the Supreme Court told the central government to frame “better guidelines” on seizing media professionals’ devices that don’t violate the fundamental right to privacy.

Sick games: Indian celebrities are the latest target of AI-generated sexual imagery. A video of a woman in revealing clothing, manipulated to look like actress Rashmika Mandanna, went viral last week. In a similar case, an AI-manipulated scene from the upcoming film Tiger 3 featuring actress Katrina Kaif is also doing the rounds. Social media is now full of deepfake porn featuring celebrities but there’s little a victim can currently do. The government has asked social media platforms to remove deepfakes and misinformation within 36 hours after they’re first reported.

Making hay: Even as Disney searches for a buyer for the Star business, Hotstar is aggressively chasing eyeballs. The platform will stream upcoming Pro Kabaddi League matches for free for its mobile users. Already, Hotstar has broken records for concurrent viewership thrice in the ongoing men’s cricket World Cup—it currently stands at 44 million viewers during India’s match against South Africa.

Stalemate: Negotiations between the Hollywood actors’ union SAG-AFTRA and studios are stuck on a crucial point: AI. The union wants studios to pay every time they reuse an AI scan of a background actor, but the studios are unwilling to offer more than a one-time payment. Will the two sides get past this issue? The studios’ alliance has already said this is their “last, best, and final offer” although there may be wiggle room on its clauses regarding AI.

Trumpet 🎺

Dissecting this week’s viral ‘thing’

How much buzz is too much buzz?

If you work in marketing/advertising, you’ve likely worked on a pre-buzz campaign, meant to grab attention and redirect it to an actual marketing campaign. Pre-buzz campaigns used to be the occasional clever stunt, but they’re almost indispensable today. It’s no longer enough to plaster the city and the internet with your ad; you must first release an ad for your ad or your entire marketing campaign might go unnoticed.

Which is why when internet sensation Uorfi Javed made headlines (again) last week, I was a bit sceptical. In this video, posted by a well-known paparazzi photographer, Javed appears to be accosted by two women from the Mumbai Police who then arrest her for wearing ‘obscene’ clothes and take her away in a private car. For those who don’t know, Javed is famous for her sexy, revealing outfits, often made creatively from everyday objects including combs, empty chips packets, and pebbles.

Turns out, Javed wasn’t arrested after all. The whole video was an elaborate pre-buzz stunt for a new jeans collection by Freakins Jeans. I wasn’t the only one who thought the ‘arrest’ seemed made up—senior crime journalist Gautam Mengle pointed out several holes in the story, while film critic Suchin Mehrotra said he received a “tip-off” the previous day to come “capture” Javed at a Lokhandwala cafe early in the morning, the same time she was picked up by the fake police.

The joke is on Javed and Freakins Jeans, though. Mumbai Police filed an FIR against the people involved in the stunt for impersonating the police, a criminal offence. But maybe the joke is a little bit on us too; Freakins Jeans’ ad for their ‘Uorfication’ jeans collection has 1.9 million views and nearly 97,000 likes on Instagram.

That’s all this week. If you enjoyed reading The Impression, please share it with your friends, family, and colleagues. And please write to me anytime at soumya@thesignal.co with thoughts, feedback, criticism or anything you’d like to see discussed in this space. I'd love to hear from you.

Thanks for reading, and see you again in two weeks!

It was fun reading this piece. Also I would've loved if some content from Film Industry would have been covered. But Iguess it was not a big week for the industry this time . So fair enough. Keep up the good work team!