Entertain me, but for free

Indian consumers are increasingly consuming content, but they don’t want to pay for it. What are the cascading effects of this behaviour?

Good afternoon!

Welcome to The Impression, your weekly primer on the business of media, entertainment, and content.

If someone shared this newsletter with you or if you’ve found the online version, hit the button below to subscribe now—it’s free! You can unsubscribe anytime.

Last week the Federation of Indian Chambers of Commerce & Industry (FICCI) held its annual three-day media and entertainment conference called FICCI Frames in Mumbai. This is one of the largest industry body meetings and like all conferences, it has its fair share of agenda setting by sponsors and crystal ball gazing with a mostly optimistic bent. This year’s sponsors and lead speakers included Amazon Prime Video’s new country head Sushant Sreeram and Netflix India’s VP for content, Monika Shergill.

This year, all conversations were held in the backdrop of one comparison—how the M&E industry is pre- and post-pandemic. And there is both good and bad news.

Go big or go home

z yu/Unsplash

First, the good news. Indians want to be entertained, and they’re lapping up more content than ever before—movies, music, and online video (but not TV, more on that in a bit). According to this year’s FICCI-EY Media & Entertainment report (pdf) Indians spent more time than anyone else on the planet watching online sports and entertainment and listened to more music (in hours) than the global average in 2022.

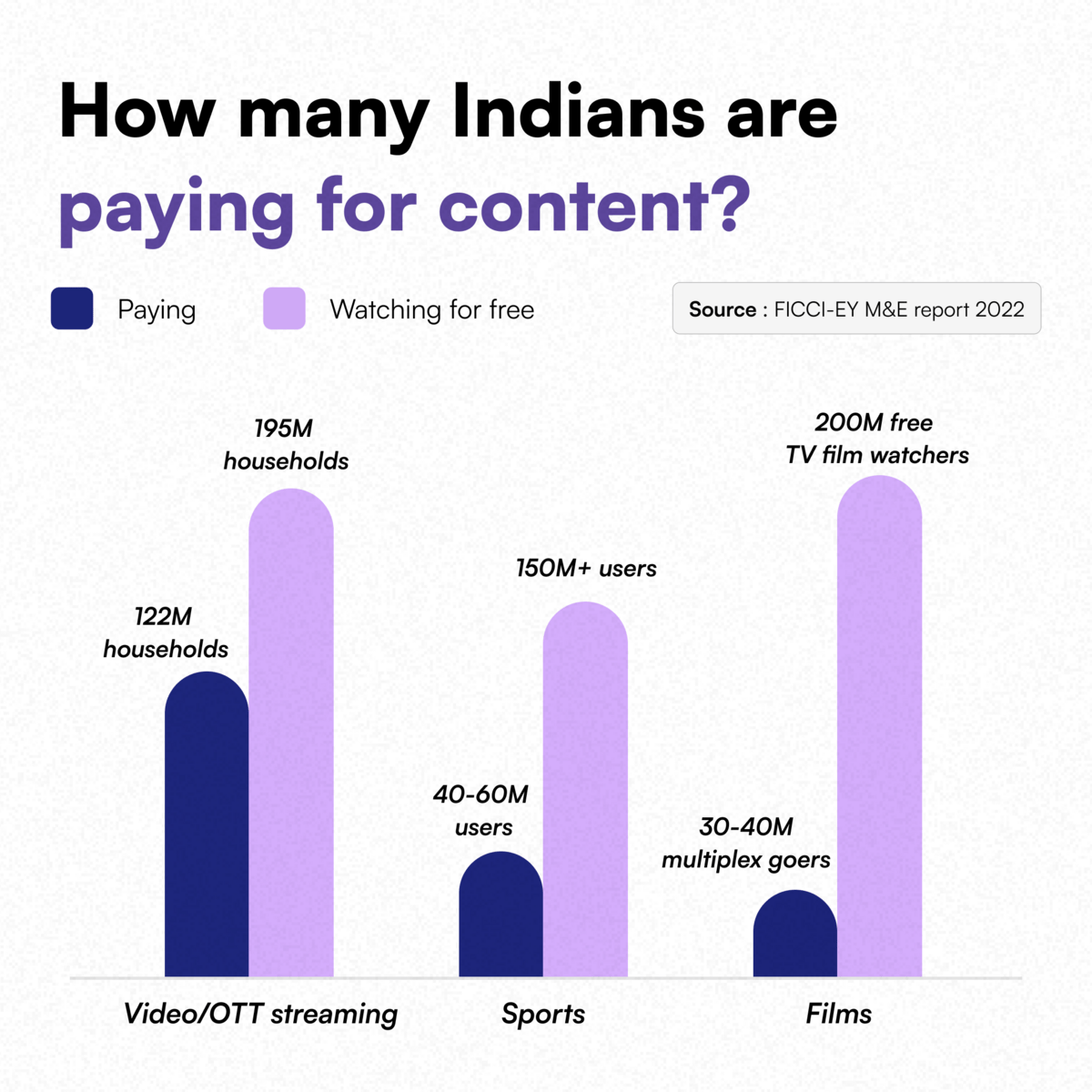

But, there is bad news. Indians don’t want to pay for content. The industry has known this for a while, but has been trying to ignore it as it goes about building premium subscription businesses, from OTT platforms with prestige shows to ad-free music streaming. But post-pandemic, the reality is clear. Subscription revenues (or direct consumer payments) in all major genres are growing slowly; and in most cases, they are below pre-pandemic (2019) levels, according to the FICCI report.

Harish Arjun/The Signal

Digital subscriptions (mostly comprising OTT subscriptions) have grown, but a lot of that is attributed to bundling - the process of offering OTT subscriptions for free as part of a bundled offering with a telecom company, a cable TV provider, or some other aggregator. I wrote about this in detail in the very first edition of The Impression. People I spoke to in the streaming business had told me they expected bundling to become the dominant way of selling subscriptions. Direct-to-consumer in the streaming business may be dying, at least in India.

The bigger concern for media companies is the shift in television, India’s biggest mass medium. Indians watched less TV in 2022 and overall impressions on all TV channels fell for a second year in row, from 1.73 trillion in 2020, to 1.59 in 2021 and 1.47 in 2022. Middle class viewers are not switching on TVs as much as they used to. The biggest drop was among NCCS CDE households, a consumer classification of homes with four consumer durables or less. And among age groups, 22-40 year olds turned away from TV the most. So, the bulk of the Indian consumer pyramid is slowly losing interest in television as social media, OTT platforms, gaming, and other forms of entertainment compete for attention.

FICCI and EY predict that the number of households with paid TV channel subscriptions will continue to decline, and that newer TV consumers will come for free-to-air channels such as DD FreeDish. Meanwhile, higher income households will ditch cable for ‘bidirectional TV’—set top boxes that double up as a streaming aggregator and a broadband provider. Linear television is getting replaced on both ends - and most of it is by households who want to watch for free.

This makes the debate over the future of the SVOD (subscription video on demand) vs AVOD (advertising video on demand) models in streaming very clear. “AVOD has already won the race, that discussion is over,” former Balaji Telefilms’ group CEO Nachiket Pantvaidya said during one session of the conference. “The biggest content investment today is being given away for free - the IPL. It means someone is doing some math somewhere.”

Harish Arjun/The Signal

Let’s look at music. YouTube is almost every Indian’s go-to platform to look for a song or build a playlist. The proportion of people who pay for music streaming subscriptions is abysmally low in India although it has grown from around three million in 2021 to four-five million last year. But, 200 million people use music streaming in India. FICCI & EY estimate this paying user base will, at best, double to eight million by 2025, with ₹3.5 billion ($42.65 million) in subscription revenue. This paying subscriber base is not going to be more than 3-5% of all music consumers, and that’s after including both streaming subscribers and people paying for concerts and merchandise. Until YouTube is around, and telecom companies offer music streaming for free (JioSaavn, Airtel Wynk), there’s not much hope for the likes of Spotify or Gaana to build a subscription-only business at scale. Since late last year, Spotify has been scaling up its ad sales team in India.

Film theatres are also struggling to get business back to pre-pandemic levels. Occupancy rates at the country’s biggest (PVR) and second-biggest (INOX) multiplex chains are still below pre-pandemic levels. PVR’s is at 29% for the 9 months ended December 2022 (pdf), while Inox is at 23% for the same time period (pdf). Hindi films, in particular, earned less at the box office in 2022 than they did in 2019, pre-pandemic. And because of lower ticket sales, people are also watching these films less when they premiere on TV. Impressions for TV movie channels were down across the board in 2022 (compared to 2020) and FICCI & EY report that the satellite rights of films are cheaper now.

Contenders, assemble

If consumers won’t pay, ads are the only way to keep business running. But the fragmentation of audiences in the sheer number of entertainment options is hurting media and entertainment businesses’ ability to earn from ads. A single music streaming service, OTT platform, or TV broadcaster cannot build audiences to a scale where ad revenues are strong enough to turn profits.

Streaming platforms are already toying with far-out ideas to make money. At the FICCI Frames conference, a panel discussion on how to monetise OTT content quickly turned into ideas on how to effectively get into e-commerce and sell customers everything from soap to games to gadgets in a bid to increase their lifetime value to the platform. The only voice to hold out against that line of thinking was Praveen Chaudhary, head of retention and growth for Warner Bros Discovery’s APAC arm. “I’m not so sure about e-commerce and content coming together. I don’t think I shop to get to know content and I don’t watch content to get to know brands,” he said.

Can this work? I don’t know. But there may be an easier way than hawking soaps in the middle of an eight-episode series – consolidate. India’s M&E industry is seeing more consolidation, more partnerships, and more dealmaking than before. Since 2019, both the number of reported M&A deals in this industry and their cumulative deal value have risen steadily, as per data from the FICCI report.

Harish Arjun/The Signal

Some of these are mega-deals that are changing the shape of the industry. The Sony-Zee merger is among the biggest—the merged business led by Zee CEO Punit Goenka is expected to be worth $10 billion, with $1.5 billion in cash balances alone. Together, Sony and Zee will have so much influence over India’s TV business that the Competition Commission of India had them sell three of their combined TV channels before merging. Zee and Sony also have a streaming app each, have market leading music labels, and run movie production and distribution businesses. Zee also has a large news business in TV, digital, and print.

The other mega deal was the merger of PVR and INOX, which created India’s largest exhibitor, leaving Carnival Cinemas and the Indian arm of French chain Cinépolis at a very distant second and third respectively. The merged PVR INOX’s market capitalisation is just over ₹142 billion (~$1.73 billion). Together, they have an even more commanding position on exhibitor revenues from films released in theatres, pricing power on tickets, and control over in-cinema advertising.

We may see more mega deals and consolidation in social media, streaming, and audio. Music streaming app Gaana has been on the block for some time, and Amazon India is in talks to acquire streaming platform MX Player.

And those who aren’t selling the business are at least making concessions on independence. South Indian languages-focused OTT platform aha was among the few that strictly kept away from any telecom or OTT bundling deals, but last month it bit the bullet and signed up to be a part of Tata Play Binge, satellite cable service Tata Play’s OTT aggregator.

As media companies aggregate content across formats and media, they will have a lot more ad inventory to sell either directly or through programmatic networks. Airtel and Jio, for instance, have already built separate ad businesses that offer inventory on everything ranging from customer apps to music streaming platforms to the content on satellite TV channels, and in Jio’s case, its streaming apps JioCinema and Voot.

More consolidation, more aggregated audiences, and more ad inventory sold in bulk always carries the risk of more fraud. FICCI & EY estimated that digital ad fraud in India was worth ₹43 billion ($520 million) in 2022 alone, and reduced return on ad spends by 11%.

Interestingly, this is the first time in a few years that FICCI has put a number to the extent of ad fraud in India. It’s odd, considering digital advertising has overtaken traditional media here, and ad fraud is globally its number one problem; ad veteran Bob Hoffman has written a book called Adscam accusing online advertising of birthing “one of history’s greatest frauds”.

Last Scroll Down📲

Free Walking Tour Salzburg/Unsplash

What’s up WhatsApp: People are getting inundated with WhatsApp scam calls and messages, and unsolicited marketing texts from brands using WhatsApp for Business. One of these is a job-offer scam where someone with an international number calls you on WhatsApp to offer a “part time” job of liking videos and reviewing products online. Government officials are promising to look into it, and Meta is trying to get the situation under control with a ‘Stay Safe’ campaign guiding users on how to protect themselves from such scams. Great, now can they add a ‘Block Brand’ button in the app too?

Grabbing the bag: Two big media businesses reported earnings this past week. Apple reported $94.8 billion net total sales for the quarter ended March 2023, declining slightly year on year. Of this, its services revenue (Apple Music, cloud, other Apple subscriptions, and advertising revenue) grew to $20.9 billion, a record high for the company (pdf). But Apple’s management said in an investor call that it is facing “macroeconomic headwinds” in digital advertising and that the services business is growing because of subscriptions to services like Apple Pay. Meanwhile, Warner Bros Discovery reported a massive jump in quarterly revenues to $10.7 billion, but it turned more than $1 billion in losses despite making $50 million in adjusted Ebitda (earnings before interest, taxes, depreciation, and amortisation) from the streaming business this quarter (pdf). CEO David Zaslav promised in an investor call that the US streaming business will be profitable this year.

Let the music play: The Indian Performing Rights Society (IPRS) has won a landmark case against private Indian radio channels. The Bombay High Court has ruled that FM radio stations must pay royalties to music composers every time they play their songs. IPRS collects royalties on behalf of its members—composers, lyricists, and publishers. The defendants in this case were Jagran Prakashan group’s Radio City and Rajasthan Patrika’s FM Tadka channels (High Court judgement pdf).

One-two punch: SEBI isn’t letting up on the finfluencers’ business. First, it asked brokers and mutual funds to stop using finfluencers in marketing campaigns because they could be offering misleading advice. Its new advertising code (pdf) requires registered investment advisors to pay ₹3,000 (~$37) for permission to speak at public events or run an ad. India FinTwit is grumbling, largely because no such regulations exist for your finance creator yet.

| |||

Finfluencers get paid to speak, RIAs must now pay 3,000 rs to speak! Pay whom? The govt (appointed) BASL, under #Sebi's new advertising code. For internal AND external communications (think about a simple email to a client). Why would anyone want to enter this profession anymore. | |||

| |||

May 8, 2023 | |||

| |||

284 Likes 68 Retweets 52 Replies |

Studio state of mind: Platform exclusivity is dying. Amazon is setting up a new vertical to distribute Prime Video’s original movies and series to other media outlets. It already releases at least one marquee film in theatres every year. This distribution business will be run via Amazon MGM Studios, set up after it acquired MGM Studios in 2022. Meanwhile, Spotify is also planning to offer its original podcasts (made by Gimlet) on other platforms.

Loosen the purse strings: Indian FMCG companies are planning to raise their advertising spends back to pre-pandemic levels as their margins improve. Managements of companies such as Hindustan Unilever, Dabur India, Tata Consumer Products, and Marico told investors in respective earnings calls that they want to keep the momentum going on their marketing budgets in the coming months. The FMCG sector is India’s largest advertiser by volume and value, especially in television.

Trumpet 🎺

Instagram: Sunita Kapoor

Hindi film actor Sonam Kapoor was at King Charles’ coronation in London last week, talking about the “unity” of the Commonwealth and building a “more peaceful, sustainable, and prosperous future for everyone”. While there was chatter that she might perform at the event, Kapoor merely made a few remarks and proceeded to introduce a musical performance on stage.

Indians love to see their actors represent the country internationally—Aishwarya Rai’s Cannes appearances and Deepika Padukone for Louis Vuitton are among the best examples—but this one drew more ridicule than praise.

It’s unclear why any Indian would choose to reminisce about the legacy of the British colonial empire at their current monarch’s coronation. And Kapoor’s performance reminds me of another iconic moment between an Indian actor and the British royal family. Shilpa Shetty had famously met Queen Elizabeth in 2007 when she won the UK reality TV show Big Brother. And she was heavily criticised for her decision to curtsy before the queen in a sari rather than going for the traditional namaste.

That’s all this week. If you enjoyed reading The Impression, please share it with your friends, family, and colleagues. And please write to me anytime at soumya@thesignal.co with thoughts, feedback, criticism or anything you’d like to see discussed in this space. I'd love to hear from you.

Thanks for reading, and see you again next Wednesday!

WRT to the narrative that Indians don't pay for digital content. The following is not an apple-to-apple comparison, but it's still relevant.

In September 2009, 19 million users accessed the internet through cybercafes. Assuming an hourly internet access cost of Rs. 40 and a minimum usage of 6 times per year, 19 million+ users were spending at least Rs. 240 annually for the content available on the internet. (Though they were paying for internet access, the prevailing perception among users was that they were paying for the 'content' available on the internet.)

Even after fourteen years, acquiring 19 million direct subscribers with an annual ARPU of Rs. 240 remains a challenge for many OTT platforms. Is it because Indians don't pay for digital content, or is it due to a weak value proposition?